Have you ever heard of arbitrage trading bots – automated tools that help traders capitalize on price differences across markets? In today’s tech-driven world, these bots are becoming essential for both beginners and seasoned investors. Dive into this article to discover how arbitrage trading bots work and the real benefits they offer to boost your trading success!

What are arbitrage trading bots?

Arbitrage trading bots are software programs designed to automatically detect and exploit price discrepancies of financial assets across different exchanges. For example, if Ethereum costs $2,500 on Binance but $2,520 on Coinbase, the bot buys low on Binance and sells high on Coinbase, pocketing a $20 profit per unit. Their key advantage is executing this process without human intervention, saving time and maximizing profit opportunities.

How they work:

Arbitrage trading bots function by continuously monitoring market data in real-time, acting as tireless digital scouts for profit opportunities. These bots establish seamless connections to multiple exchanges through APIs (Application Programming Interfaces), which serve as the bridge allowing them to access live price feeds and execute trades. Their primary task is to compare the prices of assets—such as cryptocurrencies like Bitcoin and Ethereum, stocks, or forex pairs—across various platforms like Binance, Coinbase, or Kraken.

The magic happens when arbitrage trading bots detect a price discrepancy that promises a profit. For instance, if Bitcoin is trading at $60,000 on one exchange but $60,050 on another, the bot calculates whether the $50 difference exceeds trading fees and other costs. Once confirmed as profitable, it springs into action, placing a buy order on the cheaper exchange and a simultaneous sell order on the pricier one—all within seconds or even milliseconds. This lightning-fast execution is the backbone of their success, as markets are dynamic, and price gaps often close rapidly due to natural market adjustments or other traders jumping in.

What sets arbitrage trading bots apart is their reliance on precision and automation. They don’t just blindly trade; they factor in variables like transaction fees, network latency, and exchange-specific rules to ensure each move is worthwhile. Some advanced bots even monitor order book depth to gauge liquidity, avoiding trades that might get stuck due to insufficient volume. In essence, their ability to process vast amounts of data instantly and act without hesitation makes them invaluable in a world where timing can mean the difference between profit and loss.

Benefits of using arbitrage trading bots

Faster trading execution: In finance, timing is everything. Markets move fast, and price gaps can disappear in an instant. Arbitrage trading bots excel by processing thousands of data points per second, far beyond human capability. For instance, if Bitcoin spikes on one exchange while staying steady on another, the bot can complete the trade before you even open your trading app.

Reduced errors and risks: Manual trading is prone to mistakes-mistyping amounts, picking the wrong pair, or acting on emotion. Arbitrage trading bots automate every step based on pre-set algorithms, ensuring precision and eliminating human error. This is especially valuable for high-volume trades or volatile markets, where a small slip-up could lead to significant losses.

24/7 operation: Unlike humans who need rest, arbitrage trading bots work around the clock. Crypto and some financial markets never close, with prices shifting day and night. These bots ensure you never miss a chance to profit, whether it’s midnight or during a weekend holiday, making them ideal for relentless market environments.

Popular types of arbitrage trading bots

Cross-exchange arbitrage bots

The most common type, these bots focus on price differences between major exchanges like Binance, Kraken, or Huobi. For example, if XRP is $0.95 on Binance but $0.98 on Kraken, the bot buys on Binance and sells on Kraken. They thrive in decentralized markets like crypto, where prices often vary across platforms.

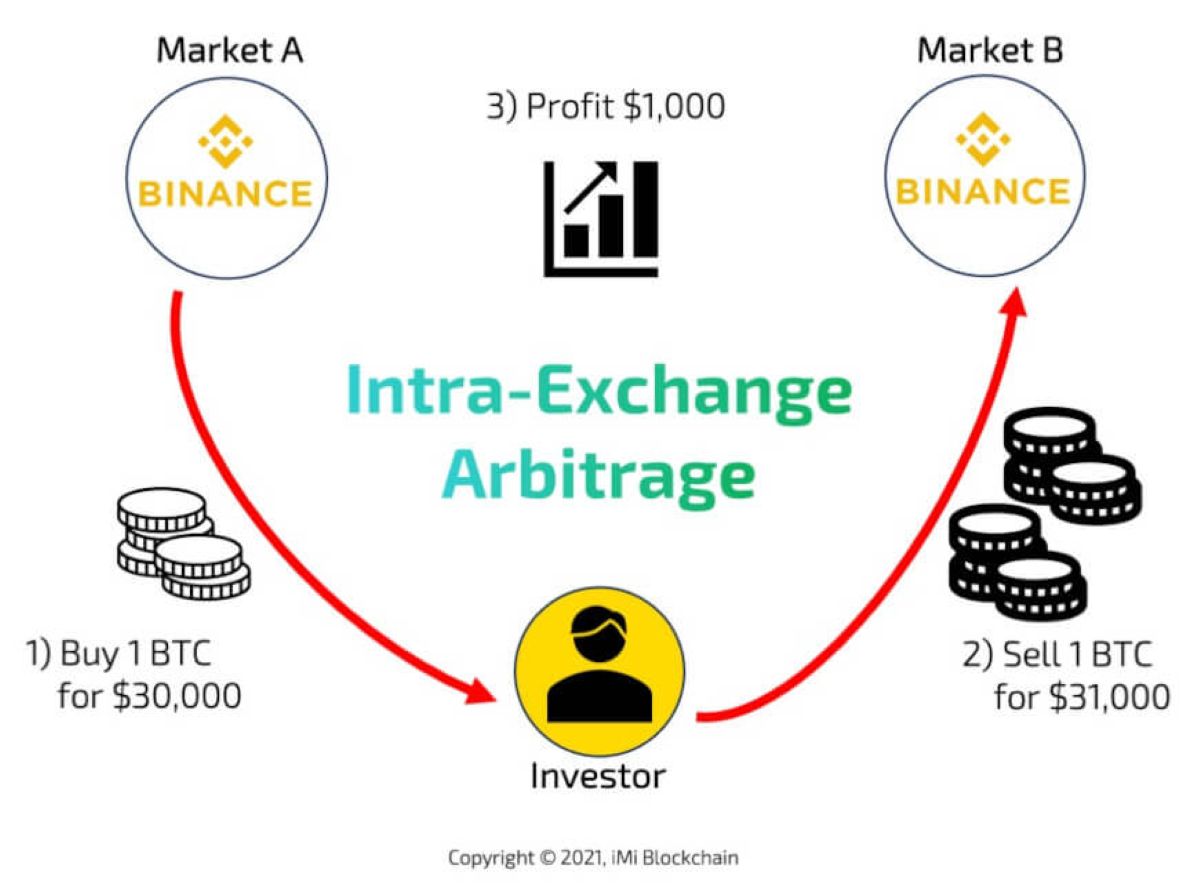

Intra-exchange arbitrage bots

These arbitrage trading bots operate within a single platform, exploiting price gaps between trading pairs. On Binance, for instance, you might buy ETH with USDT at a low rate, then sell ETH for BTC when the ratio favors you. They’re great for avoiding transfer fees or delays between exchanges.

Technical analysis-integrated bots

Unlike basic bots that only chase price gaps, these advanced tools combine arbitrage with technical analysis. Using indicators like RSI, moving averages (MA), or Bollinger Bands, they predict market trends. This hybrid approach not only profits from arbitrage but also leverages longer-term market movements, appealing to pro traders.

How to choose the right arbitrage trading bots

Assessing reliability

Selecting a dependable arbitrage trading bot is crucial, as not all options are trustworthy. Start by researching the provider’s reputation—do they have a history of consistent performance? Look for community reviews on platforms like Reddit or Trustpilot to gauge user experiences. Popular bots like HaasOnline and Cryptohopper often stand out due to their proven stability and responsive customer support teams.

These factors matter because a poorly designed bot could crash during critical trades or, worse, turn out to be a scam, draining your funds. By prioritizing reliability, you minimize the risk of technical failures and ensure your investment is in safe hands. A little due diligence upfront can save you significant headaches later.

Customization options

Every trader has unique preferences, making customization a key feature in arbitrage trading bots. A top-tier bot should allow you to fine-tune settings like minimum profit thresholds, specific assets to target (such as Bitcoin, Ethereum, or altcoins), and risk tolerance levels. This flexibility ensures the bot aligns with your trading style, whether you’re chasing small, frequent gains or larger, less frequent profits. For example, you might set it to focus only on high-liquidity pairs to avoid delays.

The more control you have over these parameters, the better the bot adapts to your goals. Without customization, you’re stuck with a one-size-fits-all approach that may not suit your needs, so prioritize bots that put you in charge of your strategy.

Cost vs. performance

Arbitrage trading bots come with a wide range of price tags, from free tools to premium versions costing hundreds of dollars monthly. Free bots might seem appealing but often lack advanced features like real-time analytics or multi-exchange support, limiting their effectiveness. On the other hand, paid options like 3Commas or Bitsgap offer superior performance, with faster execution and better profit tracking.

To find the right balance, use a demo account if available—this lets you test the bot’s capabilities without risking real money. Weighing cost against actual results helps you avoid overpaying for underperforming software or missing out on premium features worth the investment. Choose wisely to ensure your bot delivers long-term value tailored to your budget and goals.

Challenges of using arbitrage trading bots

Technical risks: Even powerful bots can falter. A software glitch or internet outage might cause missed trades or incorrect executions, leading to losses. To mitigate this, ensure your setup is reliable-use a stable server and back up bot data regularly to avoid unexpected downtime.

Market volatility: Markets aren’t always predictable. During extreme swings-like after major news-price gaps can vanish before the bot acts. This requires setting realistic trade thresholds and staying vigilant to adjust strategies when conditions get turbulent.

Legal regulations: Some regions restrict automated trading, especially in stocks or forex. Before using arbitrage trading bots, check local laws to avoid penalties or account bans. Compliance ensures your trading remains safe and legitimate.

Getting started with arbitrage trading bots

Picking a trading platform

To ensure arbitrage trading bots perform at their best, select exchanges with high liquidity and strong API support, such as Binance, Bitfinex, or KuCoin. High liquidity means there’s enough trading volume for quick order execution, preventing delays that could erase profit opportunities. Robust APIs are equally vital-they provide a stable, seamless connection between the bot and the platform, minimizing disruptions.

For example, Binance is favored for its deep market depth, while KuCoin offers diverse altcoin pairs. Choosing the right exchange sets the foundation for efficient bot operation, so prioritize platforms that balance speed, reliability, and asset variety to match your trading goals.

Setting up and testing

Begin by downloading your chosen arbitrage trading bot and configuring its basic settings: initial capital, target assets (like Bitcoin or Ethereum), and desired profit margin. Start small—investing $50-100—to test its real-world performance without risking too much. Run the bot for a few days, observing how it handles live market conditions. This trial period helps you spot potential issues, like slow execution or misconfigured parameters, before committing larger sums.

For instance, if it misses trades due to latency, adjust the settings or check your internet connection. Testing ensures your bot is ready to scale up effectively, giving you confidence in its reliability and profitability..

Monitoring and optimizing

Automation doesn’t mean you can set and forget arbitrage trading bots. Regularly check their trade logs to analyze profits, losses, and overall performance. If the bot is over-trading with tiny margins – say, earning pennies too often – adjust the profit threshold to target larger, more meaningful gains. For example, raising the minimum profit to 0.5% might reduce trade frequency but boost long-term returns. Look for patterns: Are certain assets underperforming? Is latency an issue?

Fine-tuning based on these insights keeps your bot aligned with market conditions and your goals, ensuring it delivers consistent value over time rather than just short-term wins.

Arbitrage trading bots aren’t just a trend-they’re a game-changer for maximizing profits in today’s fast-paced trading world. From lightning-fast execution to round-the-clock operation, they offer advantages manual traders can’t match. Stay ahead by following our website for more tips, guides, and insights on automated trading tech. Don’t miss out, follow MEVX Trader today to unlock valuable updates and take your trading to the next level!