Artificial Intelligence (AI) is revolutionizing industries worldwide, and financial trading is no exception. AI-powered trading bots have emerged as powerful tools, promising to transform how investors approach markets like stocks, forex, and cryptocurrencies. But are they a groundbreaking innovation or a hidden risk waiting to unravel? This article dives into how these bots work, their benefits, challenges, and their growing role in modern trading.

What Are AI Powered Trading Bots?

AI-powered trading bots are automated software programs designed to execute buy and sell orders in financial markets. Unlike traditional bots that follow fixed rules, these tools leverage AI technologies like machine learning to analyze data and make smarter decisions. They’re widely used across asset classes, from equities to the fast-paced world of crypto trading.

The rise of AI in the past decade has fueled their adoption. With markets generating massive amounts of data daily, human traders struggle to keep up. AI bots meet the demand for speed, precision, and automation-especially in volatile markets like cryptocurrencies, where timing is everything.

How AI Powered Trading Bots Work

The Technology Behind the Boys

At their core, AI trading bots rely on machine learning and big data analytics to power their decision-making. They’re trained on vast datasets, including historical market data like price movements, trading volumes, and external influences such as news events or economic reports. Over time, these bots identify recurring patterns and predict future trends with increasing accuracy. For instance, if a bot observes that Bitcoin often surges after breaking a key resistance level, it can preemptively buy when that pattern reemerges. Advanced algorithms also enable real-time adjustments, ensuring adaptability to shifting market conditions and enhancing trading precision.

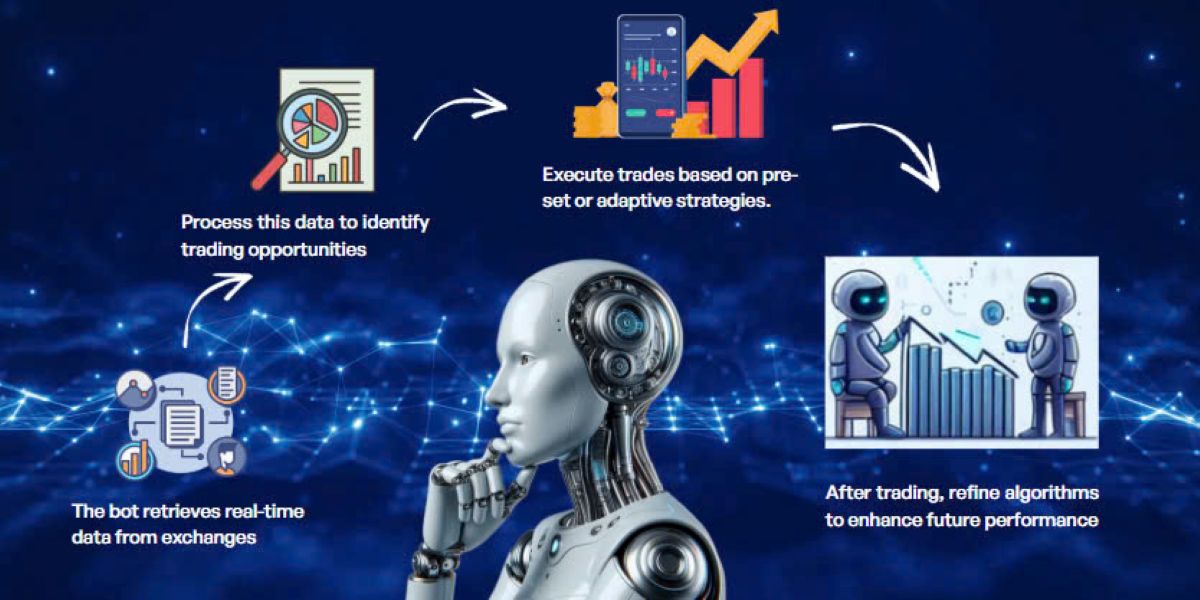

Here’s how they operate:

- Data Collection: Bots pull real-time data from exchanges (prices, volumes, market sentiment).

- Analysis: AI algorithms process this data to spot trading opportunities.

- Execution: The bot places trades based on pre-set or adaptive strategies.

- Learning: Post-trade, it refines its algorithms to improve future performance.

This self-learning capability sets them apart from older automation tools, making them highly adaptable.

Trading Strategies They Employ

AI-powered trading bots are versatile, executing a range of strategies tailored to different goals. High-frequency trading (HFT) lets them capitalize on tiny price gaps within milliseconds, ideal for fast-paced markets like forex or crypto. They also leverage technical analysis, using tools like moving averages or RSI to spot entry and exit points. Additionally, sentiment analysis plays a role-bots scan social media trends or news headlines to gauge market mood and adjust trades accordingly. This flexibility caters to diverse users, from short-term scalpers chasing quick profits to long-term investors seeking steady growth, making them powerful tools in financial trading.

Real-World Example

Consider trading Ethereum on Coinbase during a volatile period. An AI bot detects a sudden price spike triggered by a positive development update, such as a new partnership announcement. Acting instantly, it buys ETH at $2,000 before the market fully reacts. Minutes later, as hype drives the price to $2,100, the bot sells, locking in a 5% gain-all in a timeframe too fast for human traders to match. This precision highlights their practical value, especially in cryptocurrency markets where speed and accuracy can mean the difference between profit and missed opportunity, showcasing why these tools are gaining traction.

Benefits of AI Powered Trading Bots

- AI bots process data at lightning speed and eliminate emotional bias-a common pitfall for human traders. By sticking to data-driven decisions, they often maximize returns in ways manual trading can’t match.

- Cryptocurrency markets never sleep, and neither do these bots. Operating 24/7, they seize opportunities across global time zones, making them ideal for assets like Bitcoin or altcoins.

- Many platforms let users customize bot strategies-whether prioritizing steady gains or aggressive short-term trades. This flexibility suits both novices and seasoned investors.

Risks and Challenges of AI Trading Bots

No technology is perfect, and AI-powered trading bots are no exception. A single glitch, such as a software bug or an inaccurate data feed-like a misleading rumor about a market crash-can trigger significant financial losses. These technical failures underscore the dangers of depending entirely on automation without backup plans. While bots excel at processing data quickly, their inability to discern truth from noise in real time highlights a key vulnerability, making it risky to rely solely on them for trading decisions.

AI bots can struggle during unpredictable events, such as a sudden 20% market drop known as a flash crash. Without human intervention, they might overreact-selling off assets at a loss-or fail to adapt to chaotic conditions, worsening the outcome. This lack of intuitive judgment, which humans bring to the table, can amplify losses if the bot’s pre-programmed logic doesn’t account for rare scenarios. Constant monitoring is essential to prevent these automated systems from spiraling out of control during turbulent times.

Building or subscribing to a reliable AI trading bot comes with a steep price tag, often out of reach for smaller traders. Initial investments can include software development or premium platform fees, while ongoing costs-like server maintenance, updates, and data subscriptions-add up quickly. For individual investors or beginners with limited budgets, these expenses can be a barrier, discouraging adoption despite the potential benefits. This financial hurdle makes AI bots more accessible to well-funded traders or institutions than to the average retail user.

AI Powered Trading Bots in Cryptocurrency Markets

Their Role in Crypto Trading

The unpredictable swings in cryptocurrency prices make AI-powered trading bots invaluable. They shine in strategies like arbitrage, snapping up coins at lower rates on one platform and offloading them at a profit elsewhere. They also master scalping, catching tiny price shifts for quick gains. For fast-moving assets like Bitcoin or Ripple, these bots analyze market signals-like trading volume spikes-delivering rapid, calculated trades that outpace human reflexes in this chaotic digital arena.

Popular Platforms to Explore

AI trading platforms cater to varied needs. 3Commas blends ease of use with powerful automation, linking smoothly to exchanges like Kraken for real-time trades. Cryptohopper offers customizable options, letting users tweak settings based on risk appetite. TradeSanta keeps things straightforward, perfect for novices, with pre-set templates to start instantly. Drawbacks include monthly fees that can climb with premium features and initial learning curves that might challenge less tech-savvy traders.

How to Choose the Right AI Trading Bot

Picking the right AI-powered trading bot means focusing on reliability-check user feedback and track records-alongside robust security like two-factor authentication and encryption. Ensure it syncs with exchanges like Binance or Coinbase, and opt for platforms with solid customer support to tackle glitches fast. For beginners, kick off with a demo mode to test strategies safely, sticking to funds you can afford to lose while mastering features like risk settings. This blend of careful selection and cautious first steps lets you harness these tools effectively, whether diving into crypto or traditional markets.

The Future of AI Powered Trading Bots

The future of AI-powered trading bots looks promising as technology races forward, poised to redefine financial trading. Advances in AI could make these bots smarter, integrating cutting-edge tools like blockchain data-tracking transparent transaction flows-or behavioral analytics, decoding trader psychology from social media chatter. Such enhancements would sharpen their predictive edge, enabling more accurate forecasts of price shifts in assets like Bitcoin or stocks.

As adoption surges, their impact on markets will deepen, intensifying competition and pushing traditional traders to rethink strategies or risk falling behind. Automated trades could dominate volume, reshaping market dynamics and liquidity patterns. While this evolution offers opportunities for profit and efficiency, it also raises questions about stability in a world where machines increasingly steer the financial wheel, blending innovation with new challenges for regulators and investors alike.

Breakthrough or Trap?

AI-powered trading bots bring clear benefits-lightning-fast trades, unmatched efficiency, and 24/7 operation across markets like stocks and cryptocurrencies. Yet, they’re not foolproof. Technical glitches, such as misreading volatile trends, or high setup costs can turn promise into peril, proving they’re tools, not miracles. Success hinges on grasping their strengths-like precision in scalping-versus limits, like over-automation risks. Ready to dive in? Research a bot matching your goals, whether chasing crypto gains or steady equity growth, and elevate your trading with informed strategy.

Curious about AI-powered trading bots and how they can shape your financial journey? Follow MEVX Trader to explore fresh insights, practical tips, and updates on the latest tools-perfect for anyone looking to navigate the trading world with ease and confidence