Backtesting crypto bots has become an indispensable tool for traders in the volatile world of cryptocurrency, allowing them to test strategies without risking real capital. In a market as unpredictable as crypto, backtesting crypto bots enables you to evaluate how your bot performs using historical data, optimizing profits while minimizing losses. This article will provide a comprehensive guide on how to conduct backtesting, from selecting the right tools to analyzing results and offering practical tips for maximum effectiveness. Let’s dive in and enhance your trading skills today!

What Are Backtesting Crypto Bots and Why Are They Essential?

Backtesting crypto bots involves using historical trading data to assess the performance of an automated trading strategy. For instance, you might test a strategy where the bot buys when the RSI drops below 30 and sells when it exceeds 70, running it against six months of past data to see the outcomes. This process allows traders to simulate real market conditions safely, identifying strengths and weaknesses without risking capital, making it a vital tool for refining your approach.

The importance of backtesting crypto bots shines in the cryptocurrency market, where prices fluctuate wildly due to sentiment and regulatory changes. This volatility underscores the need to test strategies thoroughly before going live. Backtesting crypto bots builds confidence by revealing how your bot handles sudden price swings or trends, preparing you for live trading challenges.

Additionally, it deepens your understanding of the bot’s behavior across various market conditions, such as bull or bear phases. This insight helps fine-tune parameters and risk management, fostering a robust trading strategy. By effectively using backtesting crypto bots, traders can minimize losses and enhance profitability, setting a strong foundation for success in the dynamic crypto market.

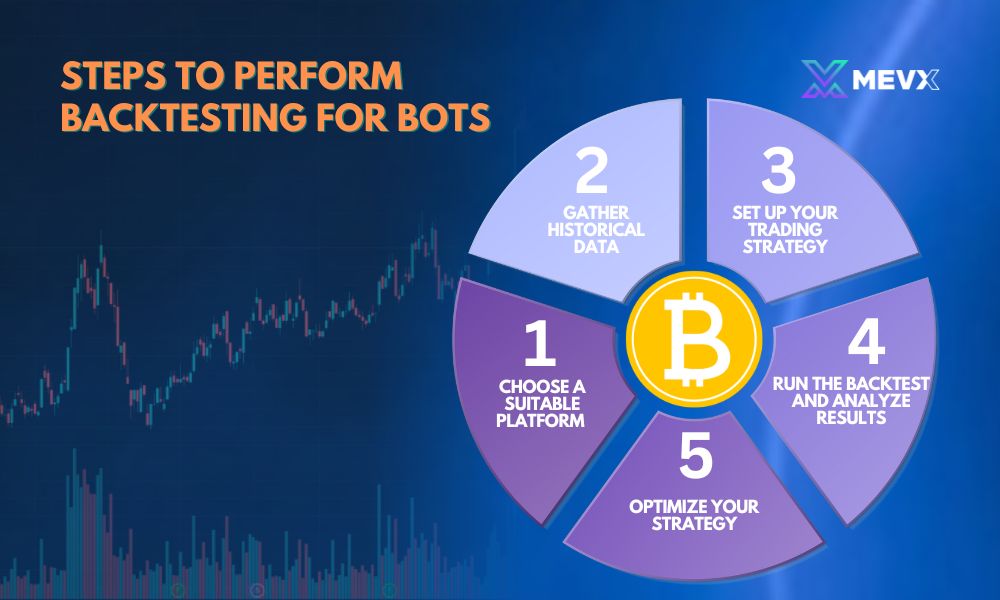

Step-by-step guide to effectively perform backtesting crypto bots

To successfully conduct backtesting crypto bots, follow these clear steps to ensure a thorough process.

Step 1: Choose a suitable platform

Start by picking a platform that aligns with your skill level and goals for backtesting crypto bots. If you’re a beginner, tradingview is a great option due to its intuitive interface and built-in tools for testing strategies visually. For more advanced users, backtrader offers greater flexibility, allowing you to code custom strategies and run complex simulations. Research each platform’s features, such as supported indicators or data accuracy, to ensure it meets your needs.

Step 2: Gather historical data

Next, source high-quality historical data from reputable exchanges like binance or coinbase. This data should include essential details such as price movements, trading volumes, and technical indicators like rsi or moving averages over a significant period – ideally 6 to 12 months. Ensure the data is clean and free from gaps, as inaccuracies can lead to misleading backtest results, affecting the reliability of your bot’s performance.

Step 3: Set up your trading strategy

Now, define the rules your bot will follow during the backtest. For example, you might program the bot to buy when the 50-day moving average (ma50) crosses above the 200-day moving average (ma200), signaling a bullish trend, and sell when the rsi exceeds 70, indicating overbought conditions. Be specific with your parameters, such as entry and exit points, stop-loss levels, and position sizes, to ensure the strategy reflects your trading goals and risk tolerance.

Step 4: Run the backtest and analyze results

Once your strategy is set, execute the backtest on your chosen platform using the historical data. After the test completes, dive into the results to evaluate key metrics: total profit or loss, the win-loss ratio, maximum drawdown, and the risk-reward ratio. For instance, if your bot shows a high win rate but significant drawdowns during volatile periods, it may indicate overexposure to risk. This step is crucial for understanding how backtesting crypto bots can reveal potential flaws in your strategy.

Step 5: Optimize your strategy

Finally, use the insights from the backtest to refine your approach. If the results show consistent losses during downtrends, you might adjust the rsi threshold to 65 for earlier exits or add a filter, like only trading when the price is above the 200-day ma. Test these adjustments by running another backtest to compare improvements. This iterative process of backtesting crypto bots ensures your strategy becomes more robust, preparing it for live trading while boosting your confidence and efficiency in the crypto marke.

Popular tools supporting backtesting crypto bots

When it comes to backtesting crypto bots, several tools stand out as valuable resources. TradingView is an excellent choice for beginners, thanks to its user-friendly interface and real-time market data integration. On the other hand, Backtrader caters to more advanced users, offering the flexibility to write custom code for detailed bot control. Additionally, QuantConnect is a powerful platform with a large development community and support for diverse strategies. Each tool has its own strengths and weaknesses, so it’s worth experimenting to find the best fit for your trading style. Using backtesting crypto bots with these tools can save time and allow you to focus on refining your strategies effectively.

Tips to optimize results from backtesting crypto ots

To achieve the best outcomes when performing backtesting crypto bots, consider implementing a few key tips. First, ensure the historical data you use is accurate and comprehensive, as any discrepancies can skew the results and mislead your analysis. Additionally, rather than testing on a single timeframe, try running your strategy across multiple periods—like 1-hour, 4-hour, or daily charts—to verify its stability under different market conditions. Lastly, avoid over-relying on backtest results alone; instead, test your bot on a demo account before going live, as real markets often present unexpected variables. These tips will make backtesting crypto bots a powerful ally, helping you craft more effective and resilient trading strategies.

Backtesting crypto bots is a vital step toward optimizing trading strategies in the dynamic cryptocurrency market. By following the detailed steps and tips outlined in this article, you can minimize risks while maximizing your potential for profit. This skill is essential for any trader aiming for long-term success. To stay updated with more insights on backtesting crypto bots and the latest trading tools, follow MEVX Trader today. Don’t miss out on elevating your trading expertise with us!