In the volatile and non-stop world of cryptocurrency, timing is everything. This is where crypto bot trading automation emerges as a powerful solution for traders seeking efficiency and precision. It allows you to execute strategies 24/7 without being tied to a screen, removing emotional bias and capitalizing on market movements. This guide explains how it works, its core benefits, and how you can get started.

Understanding the core of crypto bot trading automation

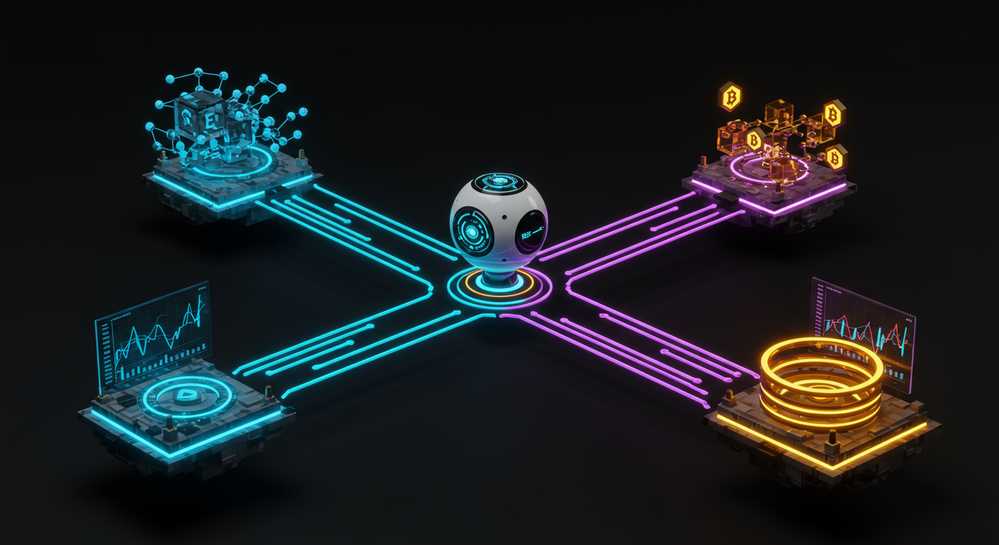

At its heart, crypto bot trading automation uses advanced software to manage your digital asset trades. This system operates around the clock, executing strategies based on a strict set of predefined rules. It removes the need for constant screen time and prevents emotional decision-making from derailing your goals. This allows traders to systematically capitalize on market volatility, a key factor in crypto bot profitability in 2025.

The core strategic advantages

The primary advantage lies in removing human limitations from the trading equation. Common emotions like fear and greed often lead to impulsive and irrational choices. By contrast, bots adhere strictly to their programmed strategy, ensuring discipline. They also process market data and react to price changes faster than any human possibly could, turning speed into a tangible asset.

- Logical Decision-Making: Bots execute trades based on pure data and logic, eliminating costly emotional errors like panic selling.

- Millisecond Execution: They analyze vast amounts of data and execute orders instantly, capturing opportunities humans would miss.

- 24/7 Market Coverage: The crypto market never closes, and an automated system ensures you never miss a move, even while you sleep.

How automated crypto trading bots execute strategies

Automated crypto bots execute trades by connecting to exchanges via an Application Programming Interface (API). This secure link grants the bot permission to analyze market data and place orders from your account. Importantly, it does not allow withdrawal access, keeping your funds secure. The core of crypto bot trading automation lies in its strategy, which uses technical indicators and preset rules. When market conditions match these parameters, the bot acts instantly.

Common automated strategies

Different bots are designed for specific market conditions and goals. The most effective ones rely on proven trading principles executed with machine-like precision. Here are a few foundational strategies:

- Grid Trading: The bot places a series of buy and sell orders at set intervals, creating a grid. It profits from price fluctuations within a specific range, making it ideal for sideways markets.

- Dollar-Cost Averaging (DCA): This strategy involves buying a fixed amount of an asset at regular intervals. It helps average the purchase cost over time, reducing the impact of volatility.

- Arbitrage: Specialized arbitrage trading bots scan multiple exchanges for price differences. They buy an asset where it is cheap and sell it where it is expensive for a quick profit.

Key advantages and risks of trading automation

While crypto bot trading automation provides powerful tools, a balanced view is essential. Success depends on matching the right strategy to the right market conditions. Understanding both the capabilities and the limitations of these systems is crucial before you commit capital. Here is a clear breakdown of what you should expect.

The strategic benefits

The primary advantage is executing a high volume of trades with unmatched speed and precision. Automation also unlocks the power of backtesting crypto bots, allowing you to test strategies on historical data before risking funds. This process provides valuable insights into potential performance. Furthermore, bots enable effortless diversification by managing multiple trading pairs at once, spreading risk across the market.

The inherent risks to consider

No trading strategy is without risk. Bots are tools that follow instructions and cannot adapt to sudden market crashes or black swan events. A poorly configured bot or a flawed strategy can result in significant losses just as quickly as it can generate profits. Technical issues like API downtime or platform bugs can also disrupt trades. Therefore, choosing a reliable and secure platform is non-negotiable.

Choosing the right platform for your trading goals

Selecting the right trading bot platform is a critical step in your crypto bot trading automation journey. A powerful tool can amplify your strategy, while a poor one will undermine it. Your decision should balance security, features, and user experience with your personal trading goals. It is vital to look past marketing claims and assess the core technology and support offered by the provider.

To make an informed choice, evaluate potential platforms against these key criteria:

- Security: The platform must use API keys with restricted permissions, meaning no withdrawal rights. Features like two-factor authentication (2FA) are non-negotiable.

- Reliability and Performance: Look for a proven track record of high uptime and fast order execution. Delays can be costly in a volatile market.

- Supported Strategies: Ensure the platform offers the strategies you intend to use, whether its Grid Trading, DCA, or more complex options.

- User Interface (UI): A clean and intuitive interface is crucial. You should be able to configure, monitor, and adjust your bots with ease.

- Pricing and Fees: Clearly understand all subscription costs and trading fees. These expenses directly impact your overall profitability.

Ultimately, crypto bot trading automation provides a systematic and disciplined framework for navigating the cryptocurrency markets. It empowers traders to execute complex strategies around the clock, turning volatility into opportunity. By understanding the technology and selecting a secure, reliable platform, you can effectively leverage automation to achieve your financial objectives. Explore your options today with Mevx Trader and take the next step in your trading evolution.