The Tariff Wave of Trump–a 25% tax on goods from Canada and Mexico effective March 3, 2025 – is shaking the cryptocurrency market. Bitcoin has plunged from $94,000 to below $86,000, mirroring investor fears amid global economic uncertainty. This bold policy not only affects neighboring countries but also ripples through risk assets like crypto. This article explores the context, fallout, and future prospects of the market in this chaotic period.

The Tariff Wave of Trump and the Global Economic Context

Trump’s tariff wave, announced by President Donald Trump, will impose a 25% duty on imports from Canada and Mexico starting March 3, 2025. Designed to shield the U.S. economy, cut trade deficits, and advance the “America First” agenda, it’s raising fears of an impending trade war. Trump has wielded tariffs before-imposing 25% on steel and 10% on aluminum in his prior term, later easing them for some nations. Now, with a tougher stance, Trump’s tariff wave is pressuring trade partners and global financial markets, from stocks to cryptocurrencies.

This policy threatens to disrupt North American supply chains, inflate commodity prices, and undermine investor confidence. For the crypto market, hypersensitive to macroeconomic shifts, the impact of Trump’s tariff wave is proving inescapable.

Impact of Trump’s Tariff Wave on Bitcoin and Crypto

Bitcoin Falls from $94,000 to Below $86,000

Trump’s tariff wave has struck the crypto market hard, driving Bitcoin from $94,000 to below $86,000 in just 24 hours (March 3, 2025). CoinGecko data shows an 8-10% drop, fueled by panic as investors brace for economic turbulence. Bitcoin hit $109,000 after Trump’s January 20, 2025, inauguration, lifted by hopes of crypto-friendly policies, but has since lost nearly 24%. Altcoins like Ethereum (-8.3%), Solana (-5.7%), and XRP (-6.8%) also suffered. The crypto market cap shrank to $1.57 trillion, down over $200 billion in two days.

The root cause is waning faith in risk assets as global markets face fresh instability. Trump’s tariff wave isn’t just hitting Bitcoin—it’s rattling the entire crypto industry.

Crypto Market: Fear Grips Investors, Yet Opportunities Arise

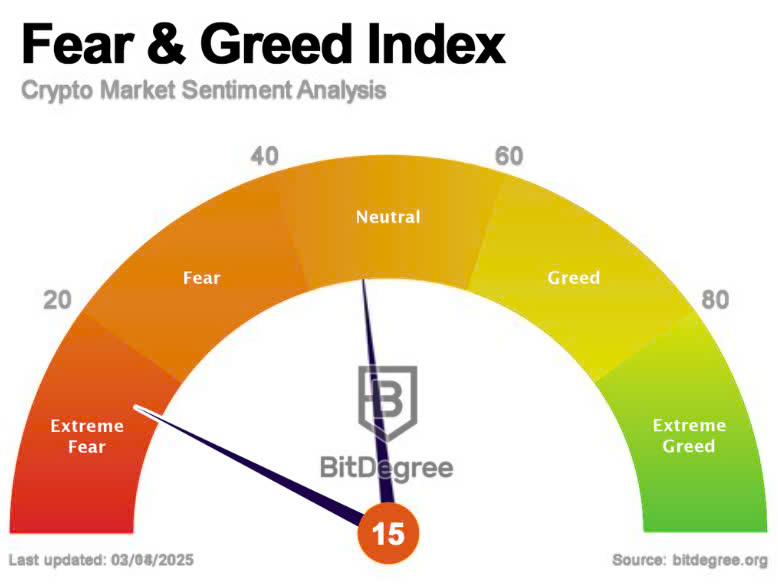

Trump’s tariff wave has driven the Crypto Fear & Greed Index to “extreme fear” (10 points) as of February 27, 2025-the lowest in two years, outstripping the Bybit hack’s $1.46 billion fallout. Investors’ trust in risk assets like Bitcoin is faltering, with many doubting its “safe haven” status amid economic chaos. Still, crises breed opportunity. Ben Simpson of Collective Shift contends, “Buying when others fear can position you for the recovery wave.” Some speculate DeFi could emerge as an alternative if the U.S. dollar weakens under tariff strain. The big question lingers: Can Bitcoin hold its ground as a store of value in this economic storm?

The crypto market faces a fork-further decline or a bounce-back if tariffs ease.

Market Forecast and Advice for Investors

Upcoming Volatility

Trump’s tariff wave, set to impose a 25% tax on goods from Canada and Mexico starting March 3, 2025, looms as a significant threat to Bitcoin’s stability. Analysts caution that if this policy triggers widespread selling, Bitcoin could dip below $80,000-a level not seen since early 2025. The market’s recent loss of over $200 billion in capitalization within just 48 hours highlights the gravity of the situation, with major investment funds potentially amplifying the downturn by exiting crypto positions. This volatility stems from heightened economic uncertainty, as Trump’s tariff wave risks disrupting trade flows and inflating costs across North America.

However, there’s a silver lining. On February 3, 2025, Trump postponed a similar tariff plan, sparking a swift Bitcoin recovery to $100,000 within days-an encouraging precedent for optimists. Some experts even speculate that the U.S. government might turn to Bitcoin as a strategic reserve, leveraging its decentralized nature to hedge against global economic turbulence. While the immediate outlook remains precarious, these factors suggest that a rebound isn’t out of reach if policy adjustments ease market fears. The coming weeks will be pivotal in determining Bitcoin’s trajectory.

What Investors Should Do Now

For investors navigating the fallout of Trump’s tariff wave, caution is paramount, but so is strategic awareness. With the policy’s rollout slated for March 3, 2025, staying updated on its progress is essential, as it could dictate Bitcoin’s next move. Long-term optimists might see the current dip-Bitcoin hovering below $86,000-as a rare buying opportunity, banking on a potential recovery akin to the February rally to $100,000. Historical patterns support this: crypto often rebounds after policy-driven shocks subside.

Conversely, risk-averse investors should hold off, awaiting concrete signals of stabilization, such as a tariff delay or softer U.S. economic data. Diversifying into stablecoins or DeFi platforms could also mitigate exposure during this storm. Regardless of your approach, information is your edge-monitor trade negotiations, Federal Reserve responses, and market sentiment closely. Trump’s tariff wave has already shaved billions off the crypto market cap, but it’s not a death knell; it’s a test of resilience. Don’t let fear dictate your decisions-whether you buy, hold, or wait, timing and knowledge will separate winners from losers. Act decisively, but act informed, to keep the crypto market’s potential within your grasp.

Stay ahead of the curve with the latest crypto and economic updates! Follow our website for real-time insights on Trump’s tariff wave, Bitcoin trends, and market shifts. Follow MEVX Trader now to get breaking news and expert analysis delivered straight to you!