Want to know what does bonded mean in meme coins? This guide simplifies the concept, diving into bonding curves and their impact on meme coin markets. From liquidity to price dynamics, we uncover how bonding shapes these viral tokens in the crypto world.

The Basics of Bonding in Meme Coins

Meme coins have taken the crypto space by storm, driven by internet culture, humor, and strong community engagement. One concept gaining traction in this space is bonding, a mechanism that connects a token’s price to its supply through a mathematical model known as a bonding curve. This curve dynamically adjusts token pricing as more tokens are bought or sold, automating the issuance and trading process.

Bonding is important because it eliminates the need for centralized exchanges, prices are no longer determined by order books but by a self-regulating formula. This ensures liquidity, price transparency, and easy access for investors, making meme coins even more appealing to a broader, often non-traditional crypto audience.

How Bonding Curves Work

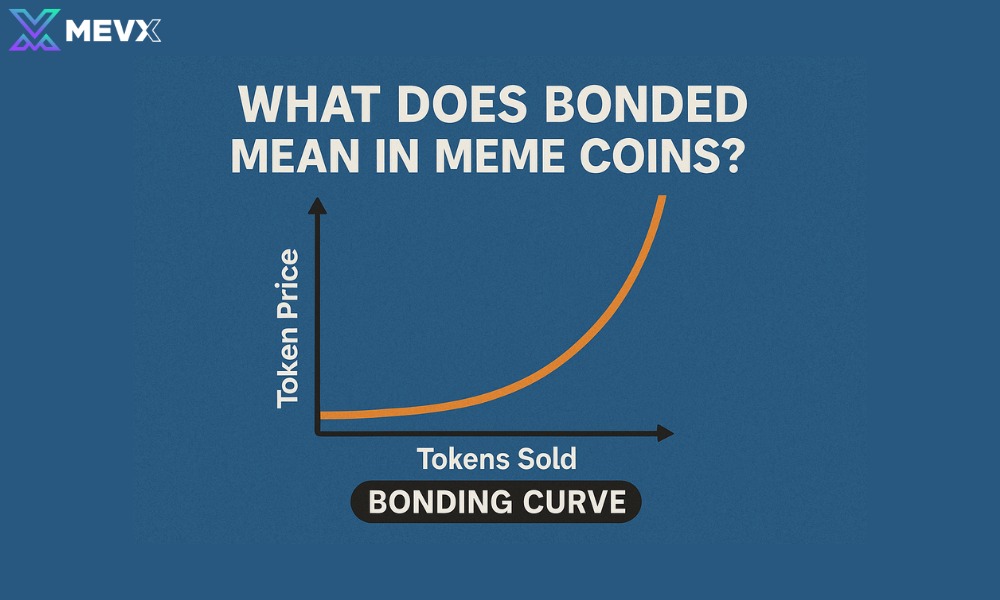

A bonding curve is the heart of what does bonded mean in meme coins. It’s a mathematical model that links a token’s price to its supply. As more tokens are bought, the price rises; when tokens are sold, it drops. This dynamic creates a predictable pricing system, unlike the wild swings of other cryptocurrencies.

Types of Bonding Curves

There are two main types: linear and exponential. Linear curves increase prices steadily, ideal for stable growth. Exponential curves, however, spike prices quickly, attracting early adopters chasing high returns. Each type shapes how a meme coin behaves in the market.

Impact on Investors

For investors, bonding curves mean early buyers often get tokens at lower prices, while latecomers pay more. This rewards early adoption but can lead to volatility if demand surges or fades. Understanding this helps you navigate meme coin investments wisely.

Benefits of Bonding for Meme Coins

Bonding offers unique advantages that make meme coins stand out. By automating pricing, it ensures what does bonded mean in meme coins translates to real benefits like liquidity and fairness for traders.

Continuous Liquidity

Unlike traditional markets where finding buyers can be tough, bonding curves guarantee you can always trade tokens. This liquidity attracts investors who value flexibility, making meme coins a hot network currency in crypto circles.

Encouraging Community Growth

Bonding rewards early supporters, fostering strong communities. A meme coin with a loyal following can thrive, as fans spread the word on social media, driving demand and value over time.

Risks to Watch Out For

While bonding sounds promising, it’s not without risks. Knowing what “bonded” means in meme coins also means understanding potential pitfalls that could impact your investment. One major concern is price volatility, bonding curves, especially exponential ones, can exaggerate price movements. A surge of buyers can send prices sky-high, while a wave of sellers can cause a rapid crash, making these tokens far more unstable than traditional cryptocurrencies. There’s also the threat of manipulation risks.

Some teams may design bonding curves to benefit early insiders, setting the stage for pump-and-dump schemes. To avoid falling into these traps, it’s crucial to research the project’s team, community, and tokenomics thoroughly before investing.

Real-World Examples of Bonded Meme Coins

To grasp what does bonded mean in meme coins, let’s look at real projects using bonding curves to power their ecosystems.

Pump.fun’s Bonding Model

Pump.fun, a popular platform for launching meme coins, uses bonding curves to set initial token prices. Once a coin hits a certain market cap, it moves to a decentralized exchange like Raydium, ensuring smooth trading for users.

Other Projects to Watch

Platforms like Bancor and Mint Club also use bonding to manage token supply. These examples show how bonding creates sustainable economies, even for coins born from internet jokes.

Should You Invest in Bonded Meme Coins?

Deciding whether to invest in meme coins requires a solid understanding of what bonded means and a careful analysis of the associated risks and rewards. Bonded meme coins follow a bonding curve, meaning the price increases as more tokens are bought, potentially offering early investors significant gains. However, because these projects often rely heavily on hype and social momentum, prices can drop just as quickly when interest fades.

To navigate this volatility, it’s important to diversify your investments and not rely solely on one coin. Always do your homework, study the bonding curve mechanics, assess the credibility of the team, and engage with the community. Set a budget you’re comfortable losing, and resist the urge to follow hype blindly. In crypto, informed decisions are the key to long-term success.

The Future of Bonding in Crypto

Bonding is more than just a meme coin gimmick, it’s becoming a foundational element in the evolving world of digital currencies. As DeFi continues to expand, understanding what bonded means in the context of meme coins could open the door to new investment and utility opportunities. Evolving tokenomics, particularly with innovations like multi-dimensional bonding curves, are bringing added stability and flexibility to these assets.

This shift may gradually transform meme coins from purely speculative tokens into tools with real-world utility. Moreover, bonding models are now being adopted beyond meme culture, showing up in stablecoins and utility tokens, signaling their growing significance in broader blockchain ecosystems.

Bonding curves bring structure to the wild world of meme coins, offering liquidity and community incentives. By understanding what does bonded mean in meme coins, you’re better equipped to navigate this crypto trend. Want to dive deeper? Explore our MEVXTrader articles on airdrops, DeFi, and trending coins for more insights!